|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Understanding Pet Insurance with No Deductible: A Comprehensive GuidePet insurance has become an indispensable aspect of responsible pet ownership in recent years, as it provides a financial safety net for unforeseen veterinary expenses. One of the most intriguing options available in the market today is pet insurance with no deductible. This type of insurance plan can seem highly appealing to pet owners seeking straightforward coverage without the complexities associated with deductibles. In this article, we delve into the intricacies of no-deductible pet insurance, exploring how it works, its benefits, and what pet owners should consider when selecting such a policy. To begin with, it's essential to understand what a deductible is in the context of insurance. A deductible is the amount that a policyholder is required to pay out of pocket before their insurance coverage kicks in. Typically, pet insurance policies involve a deductible that the pet owner must pay annually or per incident. However, in a no-deductible plan, this upfront cost is eliminated, meaning the insurance company begins covering eligible expenses from the first dollar spent. Benefits of No-Deductible Pet Insurance

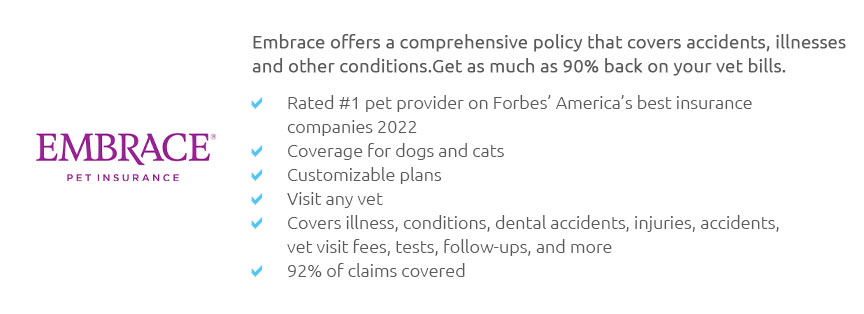

Despite these appealing advantages, pet owners should consider a few critical factors before opting for a no-deductible plan. Firstly, the premiums for such plans are generally higher than those with deductibles. This increase in cost reflects the added risk taken on by the insurer, as they must cover eligible expenses from the start. Therefore, pet owners need to weigh the higher premium against the potential savings from not having to pay a deductible. Additionally, it’s crucial to scrutinize the policy details. Some no-deductible plans might have other limitations, such as lower coverage limits or specific exclusions, which could affect the overall value of the plan. In conclusion, pet insurance with no deductible offers a compelling option for those seeking simplicity and immediate coverage. While the higher premiums might be a consideration, the peace of mind and ease of budgeting provided can make these plans attractive for many pet owners. As with any insurance decision, conducting thorough research and comparing different policies is essential to ensure that the plan chosen aligns with your pet’s needs and your financial situation. Ultimately, no-deductible pet insurance can serve as a powerful tool in providing comprehensive care for your beloved pet without the stress of upfront costs. https://www.embracepetinsurance.com/research/pet-insurance-deductible-guide

Yes. While some pet insurance companies do offer a policy with no deductible, keep in mind that you'll pay a much higher premium. https://www.petinsurance.com/

The best pet insurance ever by Nationwide. Plans covering wellness, illness, emergency & more. Use any vet and get cash back on eligible vet bills. https://www.nerdwallet.com/article/insurance/is-pet-insurance-worth-it

When the deductible is applied first: $2,000 - $500 deductible = $1,500. ... Even if you find a plan with no annual limit and 100 ...

|